It’s been a choppy year for the biotech sector—that would be an understatement. Entering into 2025 on the heels of mass layoffs in 2024, with no end in sight, was just a taste of what was to come in 2025. We aren’t even halfway through 2025, but it can be said with confidence that things aren’t going to start looking up for some time.

Over the past five years, the biotech sector has experienced three distinct phases. In 2020, there was an unparalleled surge of capital driven by the COVID-19 pandemic, followed by a period of market correction as conditions normalized post-COVID. At the onset of 2025, there was some optimism that the market would return to stability, but that expectation has faded due to ongoing market turbulence linked to U.S. President Donald Trump’s import tariffs.

Capital churn is high for biotech companies, and a marker for industry health can be gleaned from investor confidence.

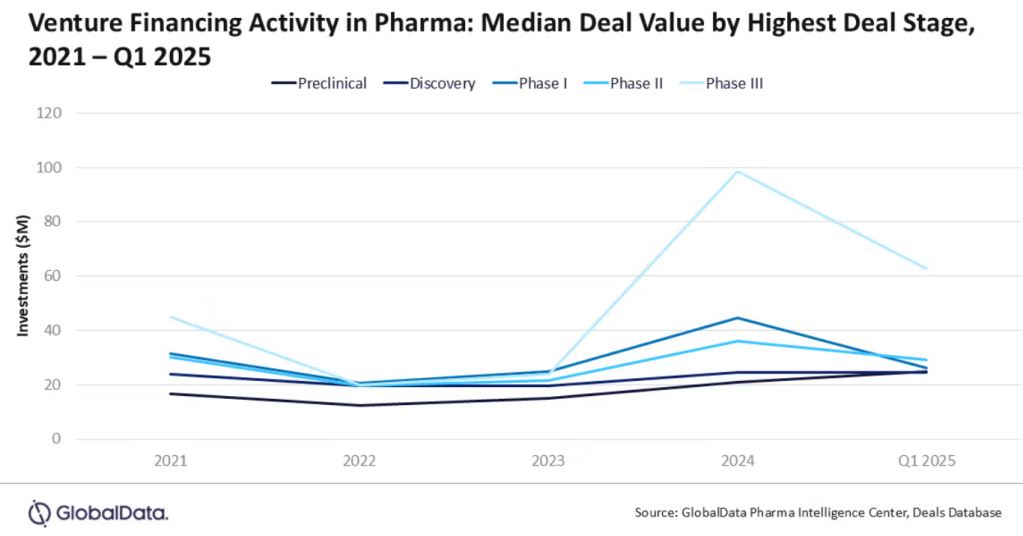

According to Global Data, a leading data and analytical company, Venture financing for bio-pharmaceutical drug companies declined by 20.2% year-over-year, dropping from $8.1 billion in the first quarter of 2024 to $6.5 billion in Q1 2025. This indicates that the bio-pharmaceutical funding landscape continues to face significant headwinds. However, funding for companies in Phase III remained high, indicating that investors still prefer late-stage companies with clinical data. Phase III biopharmaceutical companies recorded the highest median deal value at $62.5 million in Q1 2025, marking a 38.9% increase from $45 million in 2021 despite a peak in overall venture financing activity that year.

Tariffs

Though investors have been favoring biotech companies that have had a more straightforward path to market since 2023, President Trump’s tariffs have jolted investors’ resiliency in investing in assets in the healthcare sector, which is already a risky proposal. The stock market remains down 15% year-to-date. While the scope of several proposed tariffs has been scaled back, concerns about a potential deepening trade war with China (though the tariffs have been paused for 90 days) and the possible extension of tariffs to pharmaceutical products continue to weigh heavily on investor sentiment. The volatility is something companies and investors alike are grappling with. These fluctuations have caused the loss of equity for investors across the board, which in turn evaporates the funds that can be invested in the healthcare sector.

Impact of weakening FDA

In addition to the volatility caused by tariffs in the stock market, the Trump Administration has caused deep unrest in agencies such as the FDA and the National Institute of Health. Specifically, the mass layoffs have caused uncertainty for biotech companies in the stages of submitting INDs or amidst an ongoing clinical trial. This is especially disadvantageous for small biotech companies that are already scarce on resources and rely on investor funding to meet FDA guidelines. Any delay caused by the FDA for approvals can significantly impact these smaller players. Recently, around 200 biotech executives have signed a letter expressing concern about the FDA’s ability to operate effectively following widespread federal layoffs—particularly highlighting the risks for small biotech firms that rely on investor support to comply with regulatory requirements.

https://www.nopatientleftbehind.org/preserving-the-fda“While we share a desire to strengthen and modernize the FDA, we are writing to share that we are deeply concerned about the current state of the agency and its future. Specifically, we worry that the institutional knowledge that makes the FDA the world’s leading regulatory body will be irretrievably lost due to the agency’s recent reduction in force and wave of retirements. The agency’s ability to function is compounded by a hiring freeze. As a result, American patients, American industry, and American biomedical leadership will bear the consequences.”

Looking ahead

This doesn’t help reduce investors’ worries about investing in the healthcare sector. However, there are some silver linings. In the context of the tariff implications, Domestic biomanufacturing in the U.S. has been steadily growing in recent years. Today, the country is home to 1,591 biopharmaceutical manufacturing facilities spread across 48 states and Puerto Rico—a figure that has continued to rise annually.

Vivo Capital, a California investment firm, has committed to investing $750 million in pre-clinical and clinical-stage companies. Vivo Capital has deep industry knowledge and substantial experience in investing in biotech companies. Vivo has also invested in several biotech companies that major pharmaceutical firms later acquired. Notable examples include Novartis’ $3.2 billion acquisition of kidney disease specialist Chinook Therapeutics in 2023, AstraZeneca’s $1.2 billion purchase of CAR-T developer Gracell Therapeutics that same year, and Bristol Myers Squibb’s $4.1 billion acquisition of radiopharma company RayzeBio in 2024

Leave a comment