On July 9th, 2025, Merck announced the acquisition of Verona Pharmaceuticals for approximately $10 billion. This acquisition supports Merck’s science-driven business development strategy and enhances its pipeline and portfolio of therapies targeting cardiopulmonary diseases. Merck will add Ohtuvayre® (ensifentrine) to its expanding cardiopulmonary pipeline and portfolio. Ohtuvayre is a first-in-class selective dual inhibitor of phosphodiesterase 3 and 4 (PDE3 and PDE4), offering both bronchodilator and non-steroidal anti-inflammatory effects.

- PDE3 – An enzyme that is primarily involved in regulating heart and circulatory system function, including blood clotting. In the lungs, it plays a role in airway smooth muscle relaxation

- PDE4 – An enzyme that is highly expressed in the lungs, particularly in airway smooth muscle and inflammatory cells, and it contributes to airway constriction and inflammation.

Both PDE3 and PDE4 regulate inflammation by breaking down cyclic adenosine monophosphate (cAMP), a key signaling molecule involved in many cellular functions. Inhibiting PDE3 and PDE4 increases cAMP levels, and researchers have identified potential therapeutic benefits for inflammatory conditions, including chronic obstructive pulmonary disease (COPD), psoriasis, and psoriatic arthritis.

Approved by the U.S. FDA in June 2024 for the maintenance treatment of COPD in adults, Ohtuvayre is the first novel inhaled therapy for COPD in over two decades. Additionally, Ohtuvayre is currently being studied in clinical trials for non-cystic fibrosis bronchiectasis.

“This novel, first-in-class treatment addresses an important unmet need for COPD patients persistently symptomatic based on its unique combination of bronchodilatory and non-steroidal anti-inflammatory effects. We look forward to welcoming the talented Verona Pharma team to Merck.”

- Robert M. Davis, chairman and chief executive officer, Merck

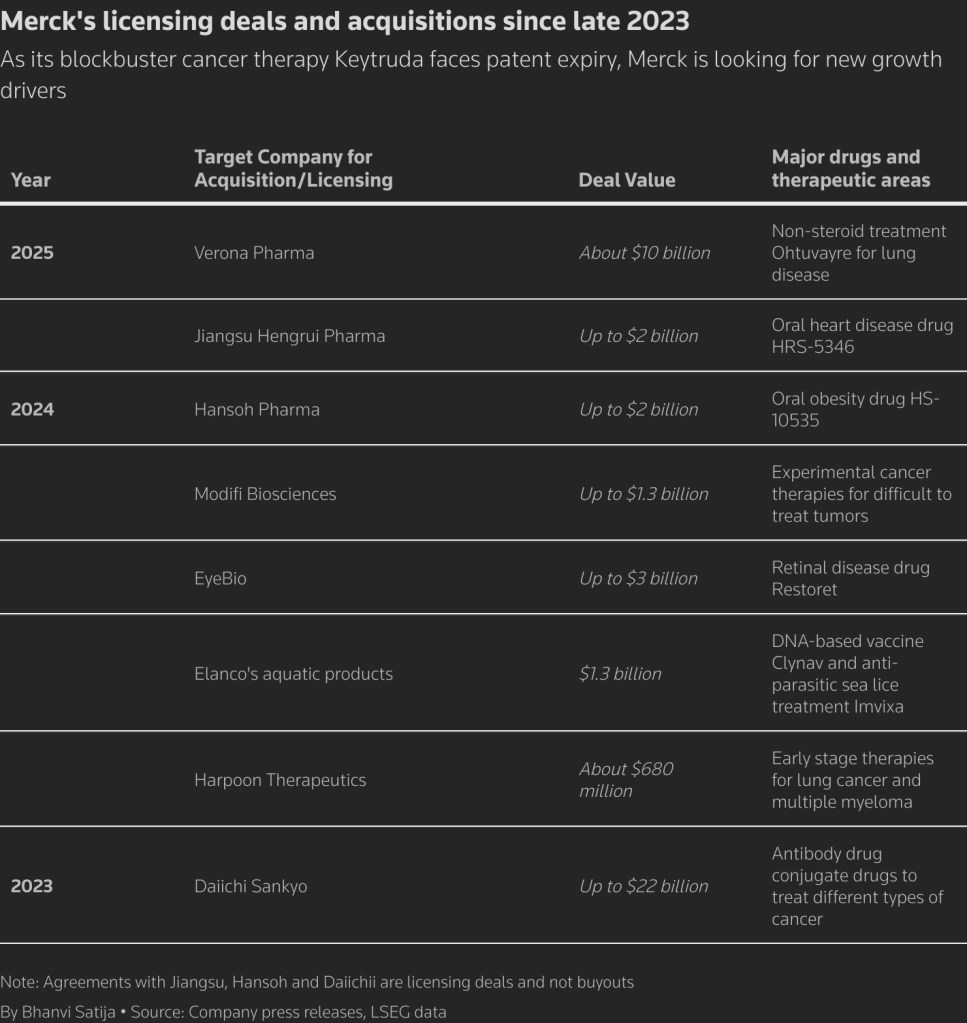

Merck’s strategically driven acquisition of Verona stems from the urgency to expand its product pipeline beyond its blockbuster drug Keytruda. Merck is expected to face revenue declines from Keytruda—the world’s top-selling drug with nearly $30 billion in annual sales—as significant patents begin to expire in 2028.

Although this acquisition eases pressure on Merck, which is looking to replace the projected revenue loss from Keytruda, the acquisition of Verona won’t completely replace it. We expect to see more deals being completed by Merck before 2025 comes to a close.

“The sweet spot we see is that $1 to $15-billion range,” Davis said in conference call on Wednesday. “As we’ve also consistently indicated, we’re willing to go beyond that for the right opportunity.”

- Robert M. Davis, chairman and chief executive officer, Merck

The FDA approved Ohtuvayre 13 months ago, marking the first new inhaled therapy for COPD in over 20 years. It can be used as a standalone treatment or alongside existing steroid therapies. As a selective dual inhibitor of phosphodiesterase 3 (PDE3) and phosphodiesterase 4 (PDE4), Ohtuvayre uniquely offers both bronchodilatory and anti-inflammatory effects, differentiating it from other COPD treatments. The drug is showing strong early performance, with $71 million in sales during the first quarter of this year—representing 95% sequential growth. Prescription volume also rose, with 25,000 prescriptions filled in the quarter, up from 16,000 in 2024.

Leave a comment